Florida Auto Insurance Rebates Total Nearly $1 Billion After Litigation Reforms

A Landmark Move in Florida’s Auto Market

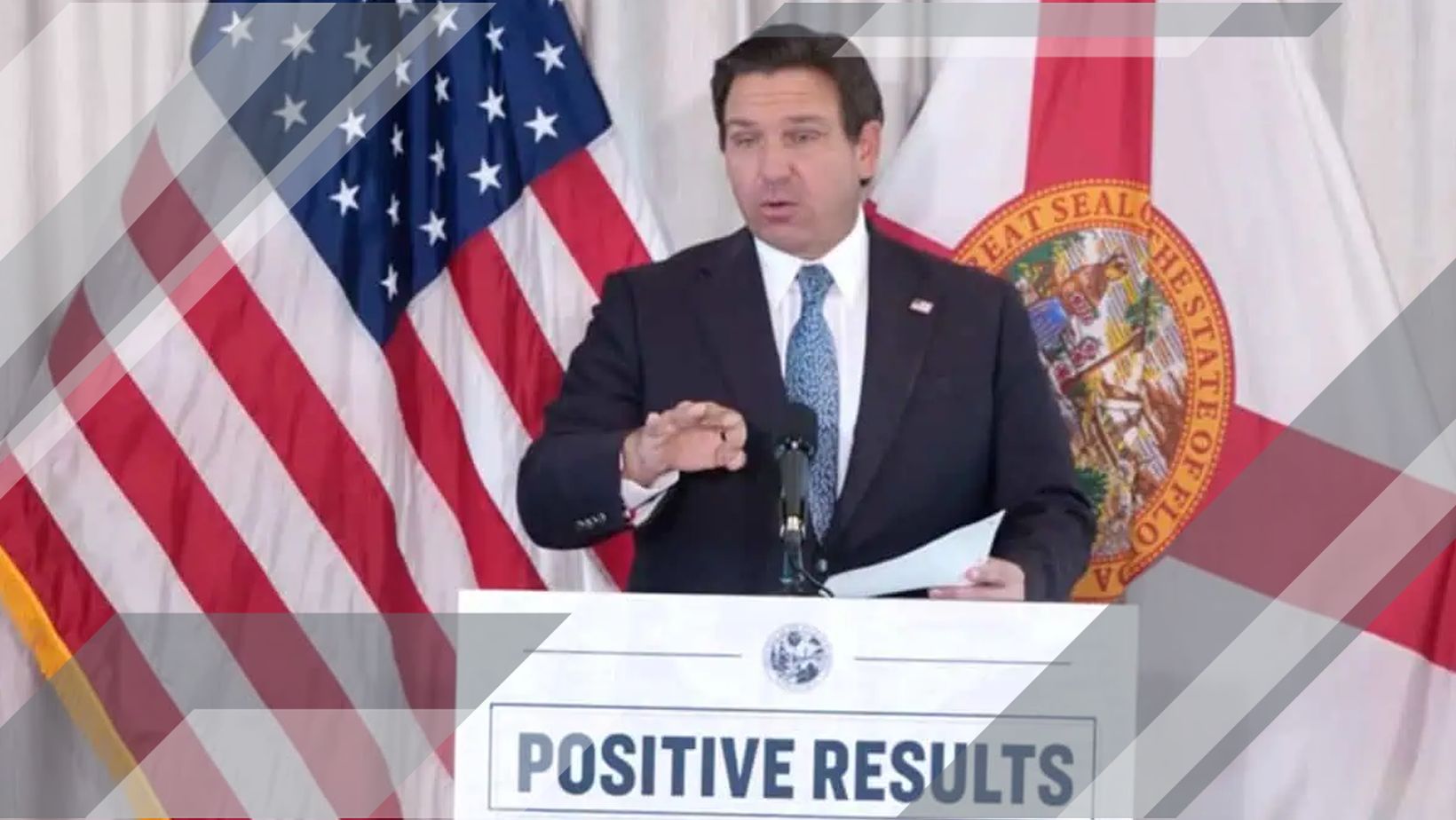

At a media event in Sarasota, Florida, Ron DeSantis announced that the state has secured nearly $1 billion in credits from Progressive Corporation for its Florida auto insurance policyholders. These credits are viewed as rebates to policyholders and reflect the effects of the state’s recent litigation-reform efforts. WJXT+2Yahoo Finance+2

Policyholders with Progressive in Florida can expect, on average, around $300 back — either as a bill credit or a direct check. WJXT+1

According to Governor DeSantis, the reforms are already having impact: “So 78 % of our auto market are the top five companies … and they are seeing reductions, and part of the reason they’re able to do that is because you have seen a decline in litigation expenses almost really immediately from when the ’22-’23 reforms were put in.” WJXT+1

Also on-hand for the announcement was Michael Yaworsky, Commissioner of the Florida Office of Insurance Regulation (OIR), who praised Progressive’s “proactive cooperation in negotiating the rebates.” Palm Beach Post+1

Why This Matters to the Insurance Industry

For the insurance sector, this moment is significant in several ways:

Legal cost control: Florida’s recent tort reforms targeted assignment of benefits (AOBs), one-way attorney fees, and other litigation levers. Florida Governor's Office+2Insurance Information Institute Blog+2

Rate relief translating into action: The top five auto-writers in Florida (who control about 78 % of the market) are showing average rate decreases of ~6.5 % for 2025, down from large increases in earlier years.

Carrier-policyholder alignment: By packaging the rebates as credits or checks, carriers like Progressive are saying “we’re passing savings to our customers” — a message that resonates in a competitive market.

Potential industry-wide ripple: Governor DeSantis indicated ongoing negotiations with other major insurers in Florida, with the goal of achieving similar rebates across the marketplace by January 1, 2026. WJXT

Regulatory-industry dynamic shift: Rather than imposing mandates, the state has opted for negotiated, cooperative changes between regulator, carrier and government — a noteworthy model for other jurisdictions examining reform.

“We are seeing steady signs of auto insurance rates dropping in Florida. Thanks again to effective legislative reforms, Florida’s auto insurance market continues to improve.” — Michael Yaworsky, Florida Office of Insurance Regulation Commissioner FLOIR

Snapshot: Reform Mechanics and Market Impact

Here’s a brief overview of the main reform levers and how they are affecting the market:

Eliminated one-way attorney fees in AOB situations

Curtailed AOB schemes, especially in auto glass and body work

Tightened deadlines and notice requirements for claim filing and suit

Improved underwriting discipline and lowered auto liability loss ratios

Increased competition with new entrants bolstering the market

Together these reforms are helping shift the auto-insurance cost curve in Florida. Insurance Information Institute Blog

What Carriers in Florida Should Be Watching

For insurers operating in—or considering entry into—the Florida auto market, there are a number of take-aways:

Work the rebate narrative: The “$300 average credit” is both a marketing tool and a customer-retention lever. Carriers that proactively engage with regulators may gain reputational and operational advantage.

Monitor litigation trends: The drop in lawsuits (especially auto glass/repair AOB litigation) is materially reducing frictional cost. Keeping tabs on legal spend is more important than ever. Repairer Driven News+1

Competitive positioning: With major carriers already filing for rate reductions, smaller or newer entrants may need to demonstrate value differentiation (service, digital tools, bundling) to avoid being squeezed on price.

Regulator relations matter: Florida’s model shows that collaborative negotiation (rather than adversarial litigation) is now a viable path. Insurers that engage constructively may find more flexibility and goodwill.

Watch for transferability of this model: Other states are observing Florida closely. Carriers that learn how to adapt to litigation-driven cost control may gain strategic advantage in evolving markets.

Why This Is a Big Deal for Auto Insurance Rate Stability

Historically, Florida has been one of the most challenging auto-insurance markets in the country. High premiums, aggressive litigation, significant assignment-of-benefit exposure and frequent reinsurance shocks made profitability and stability elusive.

By targeting the root drivers of cost (and not just the symptom of rate hikes) Florida’s reforms are beginning to yield results:

A personal auto liability loss ratio at 53.3 % in 2024 (which is among the lowest in the US) according to OIR. FLOIR

A shift from double-digit premium increases in 2023 to modest decreases in 2025 for top carriers. Florida Governor's Office+1

These are meaningful signals to the insurance industry that reform-driven markets can generate both consumer benefit and carrier stability.

Final Thoughts

For members of the insurance industry reading this blog: the Florida scenario offers a case study in how legislative, regulatory and business-model levers can converge and produce measurable change. The nearly $1 billion in credits for Progressive policyholders is more than a one-off rebate—it represents the monetization of litigation reform and cost discipline into tangible policyholder value.

As you review your own book, evaluate exposure in high-litigation states, or assess competitive risk, keep Florida’s experience in mind. This is a moment where carriers that can move fast, engage regulators constructively and position for consumer benefit may gain real advantage.

Have you conducted similar cost-and-litigation reviews in your territory? Are you ready to convert legal-environment gains into rate actions, service improvement and loyalty-building initiatives? Florida shows that when all the pieces align, the reward is not just lower rates—but a more viable, competitive and consumer-friendly market.