Verisk Reports $152B Global Annual Catastrophe Loss, Frequency Perils Intensify

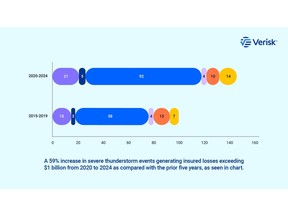

Verisk's 2025 report shows global modeled insured catastrophe losses have increased to $152B annually, driven by frequency perils like thunderstorms and wildfires. Insurance professionals must adapt risk strategies to these evolving challenges.