Earthquake Risk Management and Insurance Considerations in the U.S.

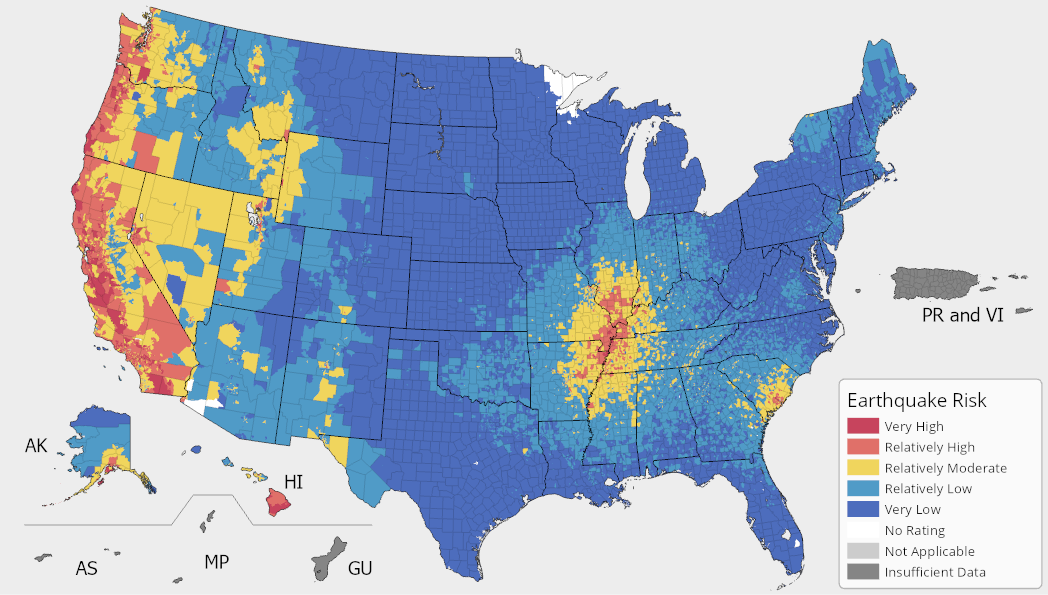

Comprehensive overview of earthquake risks, seismic hazards, and insurance implications in the U.S., focusing on risk management strategies and emergency planning in tectonically active regions.